How to Get a Credit Card In Japan – A Complete Guide For Foreigners

Tourists are always advised to bring cash when traveling to Japan. But it is crucial to get a credit card in Japan if you plan to stay here for a while. The reason is Japanese credit card helps holders make larger purchases and take advantage of many point systems here with no extra transaction or currency conversion fee (like when you use the credit card from your country). How can an ex-pat get a credit card in Japan? Read on, this article will tell you exactly all you need to know about the credit card systems in Japan as well as the application process.

1. Features of credit card in Japan

Like anywhere in the world, credit card in Japan serves as a convenient payment method.

SEE MORE:

- Using Credit Card In Japan – Payment, Cash Withdrawal And More

- How To Get A Job In Japan – A Comprehensive Guide

Like anywhere in the world, credit card in Japan serves as a convenient payment method which lets you borrow money from the banks. This sets credit cards apart from debit cards or cash which only allows you to buy things with your own money. However, for credit cards, on a specific day of the month, you will get a bank statement of an invoice that lists all your spendings and you have to pay back what you borrow. If you fail to do this on time, you will receive interest as a penalty. That’s the basis of credit cards which is the same all over the world, but credit card in Japan has some other features that are worth mentioning below.

1.1 Full credit card payment

In other countries, when your credit card payment is due, you can pay a minimum amount and delay the rest as long as may be necessary (with incurring interest). This is normally not accepted in Japan. As a credit cardholder in Japan, you are required to pay off in full within a period of a month. In detail, the bill covers from 16th this first month to 15th the next month, for example, 16th March to 15th April. At the end of April, an account summary with the note of the sum you own the bank will be sent to you. On the 10th of May, the bank will automatically withdraw that amount of money from your account (if you have enough). As you pay in full, there will be no interest.

1.2 Split up purchase payments (bunkastsu barai)

During credit card purchases, the cashier will ask you “how many times do you want to split this?”(nankai deshou ka?).

Even though credit card payback must be in full, you can choose to divide your purchase bill into many times payment at the point of sales. This is called split-up payments or installment payments (bunkastsu barai in Japanese) compared to paying in one go (ikkatsu barai). During credit card purchases, the cashier will ask you “how many times do you want to split this?”(nankai deshou ka?) or “will this be in one payment?” (ikkatsu wa yoroshi deshou ka?). If you are a customer of Japanese credit card, you can choose either. In contrast, the foreign credit cardholder can only pay one time (“ikkai ” or “ikkatsu”).

The maximum number of payments you can split is 36, but the higher that number, the higher interest calculated onto your payment (normally from 12% to 16.37% of the total). Therefore, a 100,000¥ laptop payment can be paid through 24 months with an interest rate of 15% may cost you ¥115,000 at the end. Sometimes, banks will offer interest-free installment payments if your number of payments is only 2 or 3. For more details, please read the rate table of the credit card issuing banks, usually on their brochures and websites.

1.3 Revolving payments (ribo barai)

Quite similar to the Western pay-as-you-go credit system, revolving payments (or ribo barai) is an exception to the full credit card payment rules. As an exception, it is valid only if the holder requests it successfully from the card issuers. The issuers will consider whether the holder is credit-worthy enough and make the decision of approval or not.

In revolving payments, holders can pay certain pre-determined payments and break off the rest of their balance debt over the following period. Of course, the interest rate (lower than that of installment payments) will be attached to your remaining balance monthly. For instance, this month’s statement show you owe the bank ¥100,000, you can ask for paying half and carry the rest ¥50,000 forward for maybe 6 months. Ribo barai should be a good option for someone whose budget is tight and your cost of living varies vastly every month. Additionally, Ribo barai can also help a person who is struggling through a temporary hard time.

1.4 Chargeback

What happens if your purchase is not delivered? You have the right to ask for a chargeback which is pretty possible and easy for credit cards holder in Western countries. It relatively just takes a call to the card issuers. However, in Japan, this procedure would be a little more complicated.

Let’s take SMBC cards for instance. The first step involves the holder reporting a “fraudulent transaction”, then SMBC invalidates your credit card and makes you a new one. After that, you may have to wait for up to 3 months for the money to be returned to your bank account, not your new credit. The reason for this intricate situation is that merchant seems to be more favored by bank in Japan rather than individuals customers. So, they want to prevent chargebacks that do harm to business, as much as possible.

1.5 Low credit limits

The credit limits of many regular credit cards in Japan are low, at around 100,000¥ (under $1,000).

The bad news is that the credit limits of many regular credit cards in Japan are low, at around 100,000¥ (under $1,000). With this limit, the holder is capable of buying some kinds of stuff or eating out but expensive purchases such as airline tickets would need an installments payment (bunkastsu barai). Or else, the holder can upgrade the card to Gold, Platinum, or Black for a more advantageous limit.

1.6 Credit Card Scores in Japan

With regards to checking the credit card score, Japan has unique credit bureaus. You can visit JICC website (Japan Credit Information Reference Center), quickly enter all your information. After paying ¥1,000, you will receive the credit score report in a week by mail. Another place offers credit score report is CIC (Credit Information Center). First and foremost, you also have to fill an application, and call CIC on the phone to get a receipt number. The receipt number helps you receive the report digitally as a pdf file. This process is much faster than that of JICC, even though the fee is the same.

2. Choosing a credit card in Japan

Most of credit cards in Japan partner with Visa, Mastercard, or JCB.

There is a variety of credit card options from Japanese banks, most of which partner with Visa, Mastercard, or JCB. Otherwise, you can go straight to Visa, Mastercard, American Express, and JCB offices in Japan since these are widely accepted. Please note that sometimes, payment through American Express is denied by merchants due to high merchant fees, and JCB is mainly usable in tourist destinations. Additionally, you should also decide the type of credit card suitable for you, please refer to the following information.

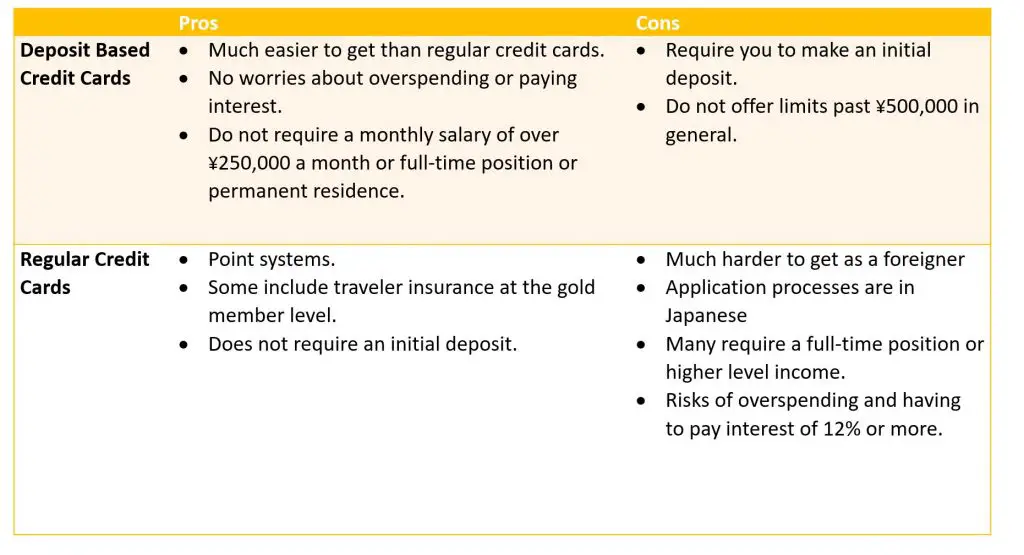

2.1 Deposit and non-deposit base card types

A deposit-based credit card requires an initial deposit and this usually the credit card limit as well. For instance, with a deposit of ¥50,000 at the beginning, ¥50,000 would serve as the credit card limit. The difference between the deposit and non-deposit base cards is mentioned below.

2.2 Yearly fee or no yearly fee

Sometimes, you may find a credit card deal with no fee but normally, from the second year, most credit card charge holders annual fee. That of gold cards will be higher than that of regular cards.

| Regular cards

|

Gold cards

|

|

| Annual fees*

|

¥515 to ¥2,160

|

¥1,950 to ¥10,800 |

* The fee could really depend on the brands. For instance, American Express charges ¥7,560 to ¥12,960 for regular cards; ¥28,080 and ¥33,480 for gold cards.

3. Best Credit Cards in Japan for Foreigners

3.1. J-Trust MasterCard

Due to this card’s great English support, it is considered the most foreigner-friendly credit card in Japan.

J-Trust Mastercard is a deposit-based credit card, so it is quite easy to get one. Due to this card’s great English support, it is considered the most foreigner-friendly credit card in Japan. The holder can apply online on the J-Trust website, which is 100% in English. It typically takes 3 weeks from your application to getting your credit card. The maximum credit card limit of J-Trust Mastercard is quite high, at 300,000 which is similar to that from major Japanese banks.

- Pros: Easy to get approval, English support, online application, fraud and theft protection

- Cons: no gold and platinum cards, no point system for users

3.2 Rakuten Card

Rakuten credit card allows credit card limit up to ¥1,000,000 with no yearly fee.

One really popular option is from Rakuten Group, the owner of Rakuten auctions and various other Internet-related services. This company issue Rakuten credit card which allows credit card limit up to ¥1,000,000 with no yearly fee. Besides, Rakuten offers an attractive point system in which the holder earns 1 point for each 100-yen payment. Then each point is converted to 1 yen, or in other words, your debt will be minus 1 yen. Last but not least, using Rakuten card for overseas travel and airport transportation, will accompany 20-million-yen travel insurance. It’s worth mentioning that without a full-time job along with a work visa, foreign residents will not meet the requirements for this card. In that case, please apply for the J-Trust Mastercard.

- Pros: no yearly fee, service insurance, large credit card limit, generous point program

- Cons: Japanese application process, work visa requirement

3.3 Lifecard

Lifecard offers both deposit and non-deposit card options.

Issued by AIFUL, one of the biggest Japanese consumer finance corporations, Lifecard offers both deposit and non-deposit card options. As long as you have lived in Japan for more than 20 years, Lifecard is really easy to get as it promises services for everyone including ones who have been overdue before or someone getting a credit card for the first time. In addition, like Rakuten card, Lifecard also has point service, ETC usage along travel insurance. One major drawback is its website and the application process is in Japanese. The limit is ¥100,000 for the standard cards and ¥500,000 for gold cards.

- Pros: little examination, travel insurance, point service

- Cons: Japanese site, annual fee (¥5,000 – ¥20,000)

3.4 MUJI Card

The benefits of holding this card are obvious as you can get special deals in MUJI stores.

Yes, MUJI is a name of worldwide famous retail store chains but there is a credit card from the same company in partnership with Credit Saison, an esteemed finance corp. The benefits of holding this card are obvious as you can get special deals in MUJI stores such as an initial 1,000 yen shopping points, points presents for birthdays, and 2,500 points to earn during first-year membership. Moreover, in MUJI week which events taking place a few times a year, MUJI card owners get 10% off sales for any item. Of course, apart from MUJI merchandise, you can use the card to shop online overseas or pay electricity bills.

- Pros: MUJI point service, discounts, no annual fee

- Cons: Japanese site

3.5 GTN Credit Card

The only requirement is that the customers have to settle in one of GTN managed condos or use their other services.

Global Trust Networks or GTN is known as one of the largest real estate, mobile, and remittance services providers for ex-pats in Japan. In affiliation with the major credit card company EPOS, GTN release a card specialized for foreigners. The only requirement is that the customers have to settle in one of GTN managed condos or use their other services.

- Pros: English support, discounts, no annual fee

- Cons: have to use their housing or other services to apply

GTN Card Website

4. Applying for a credit card in Japan

The documents you prepare for your credit card application depend on the policy of the issuers. In general, they are:

- Passport or driver’s license (as a type of identification)

- Japanese residence card

- Health insurance card (optional)

- ATM/debit card (that you use to withdraw money)

Besides, you have to provide some information related to your income, your address or how long have you stayed in your place of residence. Sometimes, the questions about your company, for example, “How many employees in your company?” “How much is your company capital”… will be asked. In other words, you have proof of our employment, earnings (normally at least ¥250,000 a month). Most issuers also require foreigners to stay in Japan for at least 6 months. This whole application process usually goes with a small deposit and it takes approximately 2 months for the bank to proceed with your forms. After that, you will know you get approval or not by a letter by post.

5. How to successfully get a credit card in Japan

There are tips to increase your chance of getting a credit card in Japan. First, you should pay attention to the following documents:

- Valid work visa (not a tourist visa), or a spouse visa (i.e. married to a Japanese), or, even better, a permanent residence visa.

- A Japanese bank account statement

- Fixed proof of address (usually a utility bill) with YOUR NAME on it

- Proof of employment and a tax certificate showing income and tax paid

But remember, if you stay in Japan for only a short time or lack a credit record, your choices of credit cards are quite limited. In the case you fail your first applications, don’t retry right away at any issuers since JICC publics your result. You should wait for some time, get yourself a job, whether as an official employee, freelancer, or contract worker. After that, you may want to have a go at an easy-going co-branded card whose services you may already use. Next, utilize any chance to establish a credit record, for example when you purchase a laptop, ask for credit and pay it back later and you can apply for a more difficult card.

FAQs

Is it difficult for foreigners to apply for a credit card in Japan?

Yes. It is nearly impossible to get a credit card in Japan if you just arrived in a few months or you don’t have work. There are other strict requirements. No matter how solid your credit history in your home country is, the card issuers in Japan attach to a different credit card system and credit agency called JICC. JICC is quite conservative as it considers foreigners as customers with a high risk, who can suddenly leave Japan without paying bills.

What are the differences between Credit Cards in Japan and America?

Apart from the difference mentioned at the start of this article, there are other minor distinctions. While credit cards in Japan have an older age requirement of a minimum of 20 years old, Americans can get a credit card even from their thirteens with parental help or wait only to 18 to apply for credit card themselves. Furthermore, if you lose your credit card in Japan, you have to pay a 1,000 yen fee instead of getting it for free like in America.

What to do if your credit card application gets rejected?

After a minimum period of 3 months, you can start applying for a credit card again. However, there is no guarantee that this time will works since the banks don’t usually explain why they don’t approve of you in the first place. Therefore, it is recommended that you consider other credit card brands, especially one specialized for foreigners as the requirements can be lower.

How to Keep a Good Credit Score?

Once you get a credit card, it is equally important to maintain it with a good credit rating. There are some factors affecting this rating, including payment history, credit age, level of debt,… Besides, you should pay off bills or loans on time and try to keep your balance low. This is because if your credit card balance exceeds 30% of your credit limit, your score would decrease gradually.